Background – Art Industry Overview

88% of wealth managers believe arts and collectibles should be offered as part of their wealth management services. In order to understand how art trading fits into the wealth management services we must first understand how the art market works and its key players:

- Art Galleries: represent artists and sell their art, they determine and manipulate price in the primary market

- Buyers: museums/galleries or high-net worth individuals who collect and sell art for both personal and investment related reasons

- Auctions houses: provide appraisal experts and venues for selling art to the public

- Wealth Managers: art buying/selling is increasing in popularity among wealth managers as another investment option for clients

There are two segments in the art market, the elite end (galleries) and low tier (small unknown local galleries outside urban areas where prices are listed and observable). Galleries represent the primary market in the elite end segment, they determine the price (which is hidden from the public) and maintains control of the price by manipulating the secondary market comprised of auction houses who make price public and sell to the highest bidder, and owners who sell their art previously bought from galleries or auction houses.

Online art market

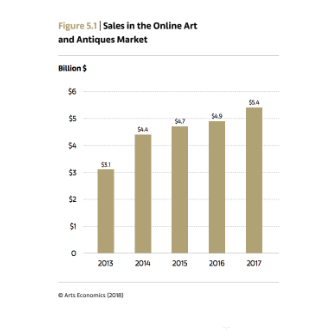

The global online art market reached $5.4B in 2017, accounting for 8% of the value of global sales. Auctions represent 47% of sales and dealers 53%. Most of them surveyed in 2017 recognized the online channel as a key area of growth for the next 5 years.

Source: The Art Market Report 2018 by Art Basel and UBS

Opportunity – Where are there pain points in the current system?

Currently pain points exist in every segment of the art trade value chain:

- Authentication & proof of ownership: The lack of a central title agency to track past ownership, as well as the reliance on human judgement, make establishing authenticity difficult and prone to many errors.

- Price valuation: The current art trading market is not liquid, and in many cases art is not sold in auction. This makes the price valuation of art highly arbitrary.

- Utilization: The current system of ownership is based on one owner utilizing one piece of art, this does not fully make use of the value of the art.

- Art investments: Even though current infrastructure exists to enable investment in arts, there is no system to support decision-making and prediction of future returns and risks.

Proposed Solution

Our proposed solution has several integrated components, each of which is comprised of existing technology that is in almost all cases open-source and available for repurposing or is reasonably replicable.

Machine Learning Platform : We see two uses, authentication and predictive analytics. Using tools available via the Google Cloud Platform, our team believes a highly accurate machine-vision model could be trained using image data collected in high definition to create a model that can identify forgeries on a going forward basis for any onboarded Art with near 100% accuracy. A recent paper by Elgammal, Yang, and Den Leew of Rutgers and the Atelier for Restoration & Research of Paintings recently used a RNN in ensemble with a “handcrafted” supervised model to achieve 100% forgery recognition on drawings. Companies Verisart and Dust both currently use machine vision to create a digital token or certificate for such assets now, and could be partnered with if the technology proves too difficult to deploy internally.

With regards to analytics, we see company Artrendex currently uses a dataset of extant artwork to formulate categories for artwork that is useful for trend identification. We believe continuing this form of research into these assets could provide insights into expected returns. Moreover, we feel that the integration of those expectations with Monte Carlo processes and traditional portfolio theory (which are employed in the structured product businesses currently) could liken this asset class to more traditional financial products. In so doing, it could be made more readily understandable and optimizable by Wealth Managers.

Distributed Ledger: Here, the Blockchain element of ArtInvest’s platform plays a role in allowing for liquidity to form for individual art pieces as ownership stakes can easily be traded. This allows for the secondary market to give accurate MTM values for pieces in more frequency than auctions and even allows for derivative products so as to hedge positions. Moreover, the operational benefits of a smartcontract enabled platform would make transaction verification and recording robust. Incorporating the requisite tax and regulatory frameworks becomes easy as it can be embedded directly into the contract logic. Else, Wealth Managers can use their existing infrastructure as an overlay to ensure compliance.

The solution is made scalable by implementing machine learning processes on the cloud and operational processes on a permissioned distributed ledger on which tokenized works can be traded. In each case, this can be done with almost entirely open-source software.

Benefits/Challenges

Benefits:

- Transparency – Sales recorded and traceable through the blockchain, ensuring information on past ownership and prices

- Liquidity – Selling shares of art increases transactions, increasing access to art ownership and accuracy of prices

- Regulation – Creating a standardized process for art sales can allow for greater guidelines and regulation for the industry as a whole

- Investment Opportunities – Increased transparency and liquidity will allow Wealth Managers to provide art investment as a trusted and beneficial investment tool in their portfolios

Challenges:

- Selling physical object on a virtual platform – Sellers can authenticate item and then deliver forgery at the time of sale, leading to potential trust issues with our platform

- Resistance in the current market – Current market is full of high net worth individuals who prefer anonymity and less regulation, which could prevent these individuals from using our product

- Lack of support from auction houses and appraisers – Auction houses and appraisers might see our process as replacing their line of business, especially if the need for appraisers decreases with our new authentication tool. We will need these market participants support to ensure our product is funded and trusted by the art selling community

Commercial Promise – What Appropriable Value is There?

ArtInvest’s initial target customer segments are dealers and wealth managers. Revenue will be generated through two main streams: rental fees from leasing out the artwork on the platform and fees from providing market intelligence and data analytics services to wealth managers.

Market opportunity for the art leasing market:

In 2017, the fine art market recorded $63.7 billion worth of sales, from 39 million transactions. Each of these art pieces sold required appraisals and validations at least once, requiring extensive time, effort, and money to sell the pieces. With ArtInvest and its machine-vision technology in identifying forgeries, we plan to help dealers and wealth managers reduce acquisition costs by 50%. We conservatively estimate that capturing 0.5% of overall transaction volumes over five years would bring in annual transaction value of $347 million by Year 5, bringing in more than $9 million in rental fees.

Market opportunity for providing art data analytics services:

In 2017, according to a study by Deloitte 88% of wealth managers said that art and collectibles should be included as a part of wealth management offering. In 2016, $1.6 trillion USD of ultra-high net worth wealth was allocated to arts and collectibles, and this is expected to grow to $2.7 trillion in 2026. We estimate that providing investment management tools to these wealth managers, based on a 2% fee would yield more than $6 million annually.

Given the potential size of the industry (1.7 trillion with $>50 billion annual sales), capturing even a small market share would bring significant incremental revenue to the company, and we foresee that with the network effect, the platform will see exponential growth once a critical amount of artworks are registered.

Potential Competition

The competition currently consists of several small ventures, largely based in London, which focus on different elements of the opportunity set. Verisart and Artrendex are startups focusing on art verification and token creation, while Codex and Maecenas are blockchain platforms , as is ArtStaq, our most similar competitor. Currently, each of these companies target the end user or “consumer” but no company is focused on developing a B2B model. ArtInvest would hope to use its technology as a backend service to existing Wealth Management firms to better leverage their expertise and existing client base but providing them a similar service as our competitors do for individuals.

Funding Needs

The estimated cost to build the platform in Year 0 is $1.05 million, the majority of which is the cost of hiring engineers. In the initial 3 months, we aim to build a minimum viable product with the blockchain and machine learning set up and a beta application, which will be tested by selected users in the art industry. The estimated cost to build the MVP is $200,000.

Appendix:

*Revenue includes: Rental fees, fees from investment management, storage fees and insurance fees. Note that both storage fees and insurance fees are expensed and do not contribute to the bottom line.

Sources

Market Size:

https://www.ft.com/content/69addf50-c5d8-11e6-8f29-9445cac8966f

https://www2.deloitte.com/lu/en/pages/art-finance/articles/art-finance-report.html

Cost of Authentication:

https://www.ifar.org/authentication.php

Codex Blockchain White Paper:

https://docsend.com/view/n4sbws8

Artrendex – Computer Vision which Verifies Art by Brush Strokes

Machine Learning Technique:

https://arxiv.org/pdf/1711.03536.pdf

Provenance Guide:

https://www.ifar.org/Provenance_Guide.pdf

Current Technology:

https://www.nytimes.com/2009/10/29/business/global/29iht-nwsmart29.html

Appraisal Info: http://www.art-care.com/articles/the-professional-art-appraisal-what-to-expect.html

Art Investment Funds:

https://www.cnbc.com/2015/05/29/wealthy-investors-dabble-in-art-investment-funds.html

Tax information:

https://www.irs.gov/pub/irs-utl/annrep2016.pdf

http://www.wealthmanagement.com/high-net-worth/basics-art-valuation

https://www.irs.gov/compliance/appeals/art-appraisal-services

https://itsartlaw.com/2017/10/13/vagaries-of-valuation-for-collections-of-artwork/

Code from GitHub:

https://github.com/ITPeople-Blockchain/auction/blob/v1.1.0/art/artchaincode/art_app.go