Jan Dutkiewicz, Department of Politics, New School for Social Research

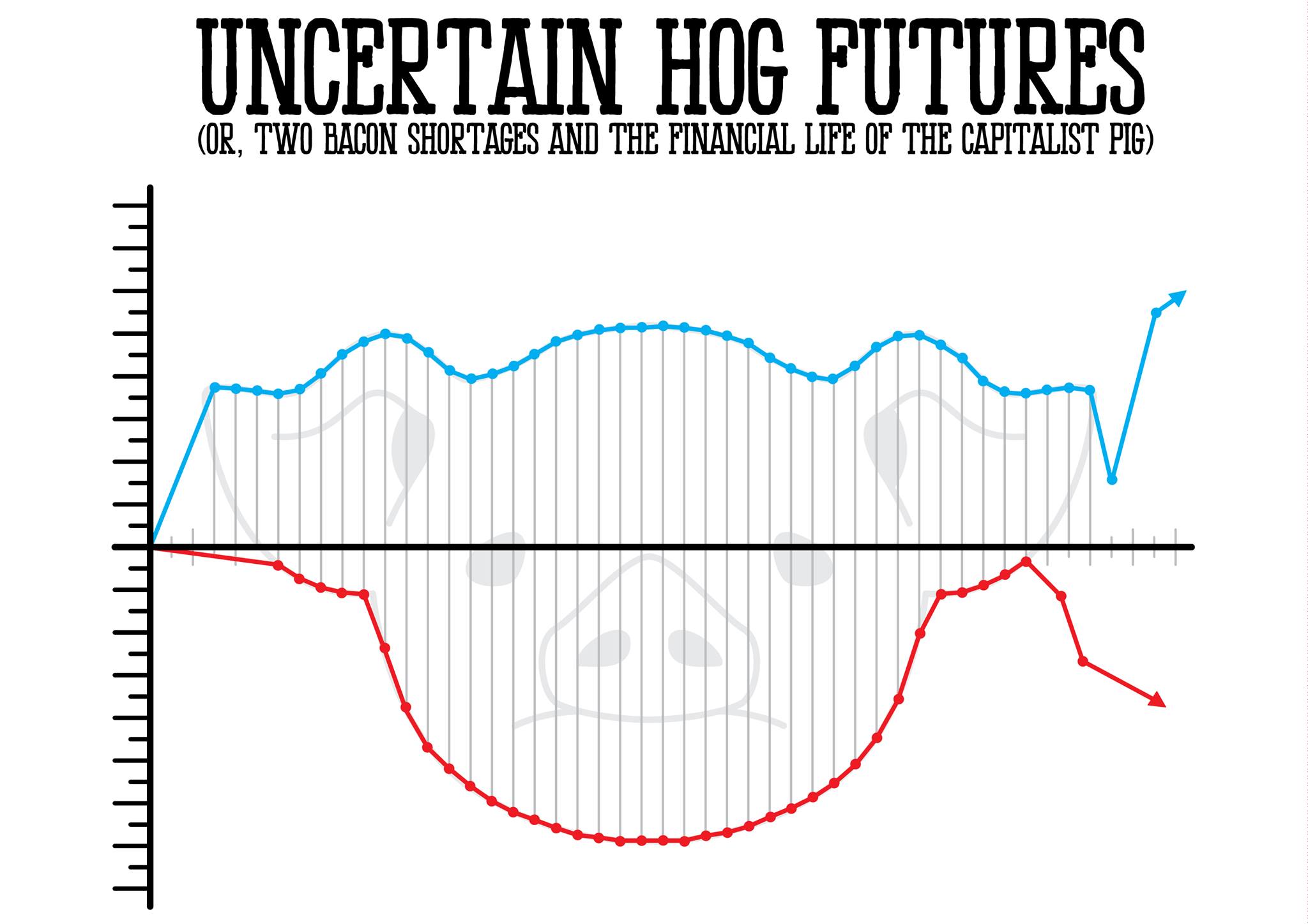

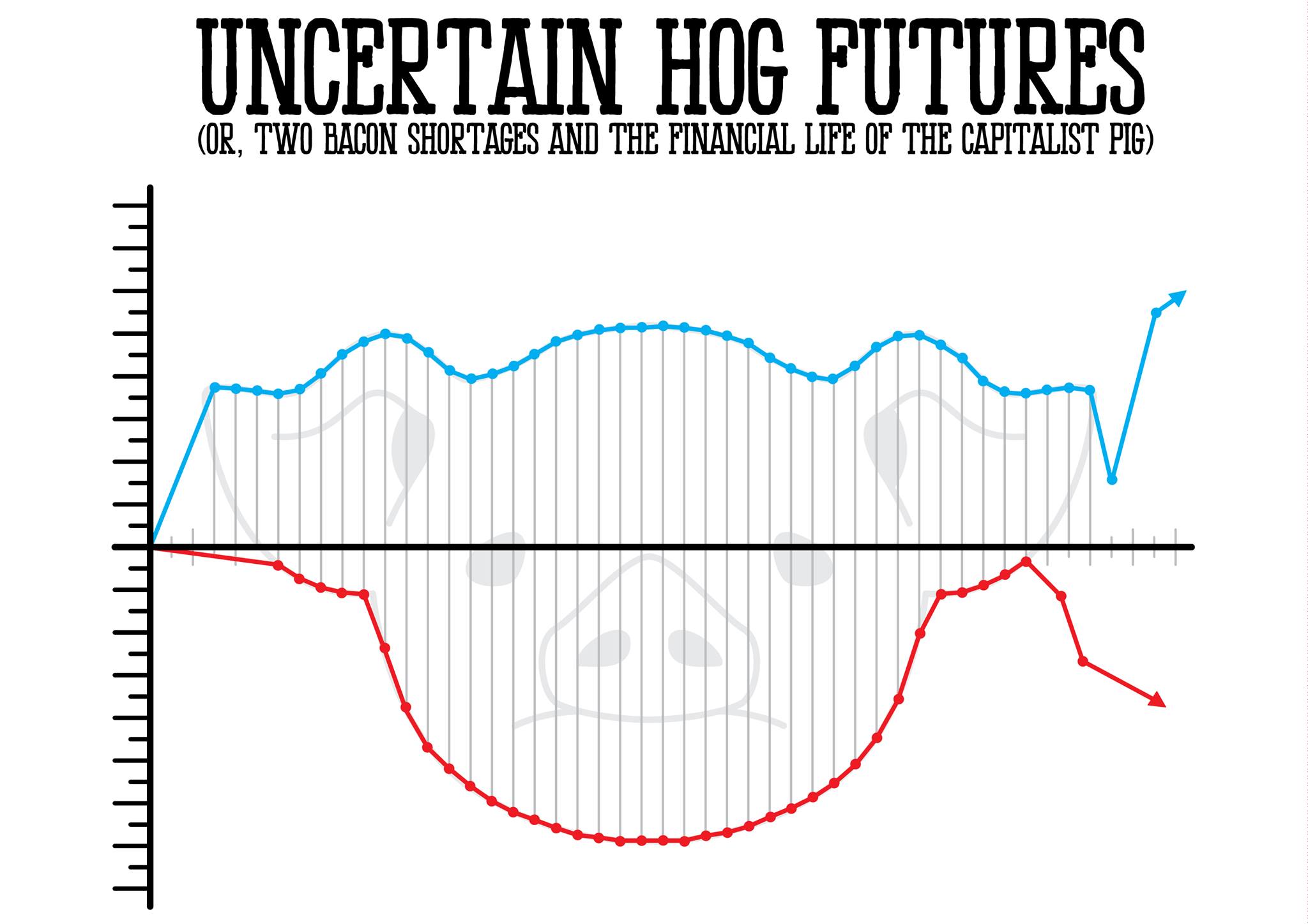

“Uncertain hog futures (or, two bacon shortages and the financial life of the capitalist pig)”

Meat is big business. The farm animal complex is a multi-billion dollar industry spanning a complex value chain that goes far beyond farms and supermarkets. The production and consumption of life and death that sets the daily rhythm of factory farming play out against an often unseen background of financial instruments and capital markets. The American hog – the standardized meat animal par excellence – is commodified through and through. Not only is it a commodity to be molded to meet consumer demand, but so too is it an asset whose value is governed by financial markets. Through an analysis of two recent “bacon shortages” – one a pure market panic and the other the result of a virus that killed millions of piglets – this paper explores the financial life of the modern mass-produced hog, tracing the (il)logics of porcine valuation in an ever-more-financialized agricultural sector. It argues that while most theories of finance focus on “abstraction” from the “real” economy, the pig is always available as a subject of intervention is response to market stimuli. In its body biology meets investor confidence, current treatment reflects futures pricing, and vitality is inextricably intertwined with market value, leaving animality itself as a source of risk to be hedged. The hog, a killable commodity whose life is dependent entirely on the vagaries of supply and demand, provides a privileged site from which to critique the operation and logics of modern markets, both revealing the violence inherent in ostensibly amoral financial transactions and troubling recent accounts of animal resistance to factory farming.

Request a copy of the paper by emailing hutch@uchicago.edu.

Light refreshments will be served.

This event is free and open to the public. Persons with disabilities who may need assistance to attend should contact Bill Hutchison (hutch@uchicago.edu).

Recent Comments