How Costly is Fraudulent Activity?

According to the Association of Certified Fraud Examiners, businesses lose over $3.5 trillion each year to fraud. As the individuals committing fraud are becoming increasingly more sophisticated and the number of fraudulent cases are increasing, there is a huge emphasis for businesses to become better at managing this activity. To become better at managing fraud, business must prevent and identify more fraudulent transactions than current methods allow for.

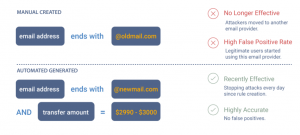

Currently, many businesses use manual rules for fraud detection and predictive prevention models. As new patterns of fraud occur, practitioners must manually update rules to manage new threats. Based on the magnitude of activity and the frequency at which fraudsters adapt to existing rules, utilizing manual rules to control fraudulent activity is arguably no longer an effective method.

Where can business turn for help?

DataVisor’s patent-pending Automated  Rules Engine solves this problem. Ultimately, DataVisor created a rules engine that adapts to changing fraud patterns. This technology automatically creates new rules to identify and prevent fraudulent activity and manages existing rules, which helps with reducing false positives resulting from outdated rules.

Rules Engine solves this problem. Ultimately, DataVisor created a rules engine that adapts to changing fraud patterns. This technology automatically creates new rules to identify and prevent fraudulent activity and manages existing rules, which helps with reducing false positives resulting from outdated rules.

How does the Automated Rules Engine work?

The Automated Rules Engine utilizes big data and unsupervised machine learning to automatically generate rules to detect and prevent fraudulent activity. Rules engines are part of many companies’ existing online fraud detection and anti-money laundering infrastructure and this technology helps banks and digital service providers recognize fraudulent activities in a more effective way.

While traditional rules engines are reactive to new attacks, unsupervised  machine learning catches evolving attacks by correlating user and event attributes, automatically enabling the system to prevent attacks of this nature. Since the rules within the Automated Rules Engine are automatically being updated and refined, an added benefit of this technology is a significant reduction in employee manual review time. With employee time freed up, this enables cyber-risk teams to perform more value-added tasks that further reduce fraud risk.

machine learning catches evolving attacks by correlating user and event attributes, automatically enabling the system to prevent attacks of this nature. Since the rules within the Automated Rules Engine are automatically being updated and refined, an added benefit of this technology is a significant reduction in employee manual review time. With employee time freed up, this enables cyber-risk teams to perform more value-added tasks that further reduce fraud risk.

Does DataVisor have a sustainable competitive advantage?

There are many competitors operating within the cyber fraud risk space. Currently, DataVisor only has a patent-pending right, which isn’t a guaranteed advantage in the marketplace. Two companies, Feedzai and Sift Science, both private entities, offer competing software that utilizes machine learning to detect and prevent fraud. Given the large market- $3.5 trillion annual revenue potential and these products effectiveness when compared to the traditional approach, there appears to be space in the market for many companies to operate successfully.

“Feedzai’s machine learning software recognizes what’s happening in the real world, how it’s different from what happened earlier, and adjust its responses accordingly. Machine Learning models can detect very subtle anomalies and very subtle signs of fraud without requiring new code or new configurations.”

“Feedzai’s machine learning software recognizes what’s happening in the real world, how it’s different from what happened earlier, and adjust its responses accordingly. Machine Learning models can detect very subtle anomalies and very subtle signs of fraud without requiring new code or new configurations.”

“Every day, businesses worldwide rely on Sift Science to automate fraud prevention, slash costs, and grow revenue. Our cloud-based machine learning platform is powered by 16,000+ fraud signals updated in real-time from activity across our global network of 6,000+ websites and apps (and growing).”

“Every day, businesses worldwide rely on Sift Science to automate fraud prevention, slash costs, and grow revenue. Our cloud-based machine learning platform is powered by 16,000+ fraud signals updated in real-time from activity across our global network of 6,000+ websites and apps (and growing).”

Is DataVisor’s Automated Rules Engine a good solution?

Although DataVisor is a private company and doesn’t release financial information, on the company’s website, it shows that the Automated Rules Engine is utilized by popular companies such as Yelp, Pinterest, and Alibaba Group. Based on these successful companies’ utilization of the DataVisor product despite having access to competing products, we can assume that the product has some value within the marketplace.

As the machine learning technology relies on pattern recognition to identify fraudulent activity, it is dependent on fraudsters repeat use of historical actions. With sophisticated fraudsters constantly coming up with innovative ways to commit fraud, the machine learning tool, although more effective than manual rules, does not provide the ultimate solution.

Despite this shortfall, since fraud continues to be an expensive threat, companies will likely pay for the best option on the market to counteract this threat. Given the product attributes and an examination of competing products, we believe DataVisor’s Automated Rules Engine has a high likelihood of future commercial success.

To increase this likelihood, DataVisor should use machine learning to review actual fraud situations that were not predicted by technology and automatically create rules. An additional feature that stops users committing “abnormal” activities would also be beneficial.

Work Cited

http://www.statsoft.com/Textbook/Fraud-Detection

https://venturebeat.com/2017/02/18/how-ai-is-helping-detect-fraud-and-fight-criminals/

8|