Opportunity: the growing EV market exacerbates existing challenges for electric utilities.

Electric Vehicles (EVs) are a rapidly growing market that’s expected to grow to significant size in the next decade. Below charts are from the International Energy Agency’s Global EV Outlook 2017 report and Edison Electric Institute’s prediction that the US will have 7M EVs by 2025.

Energy Utilities are taking notice. Utilities actively encourage EV adoption as they view it as an important future revenue stream. Southern California Edison’s report on EV adoption notes that utilities care about the location, charging schedule, and habits of EV owners. And, for good reason — EV households have significantly different energy use profiles:

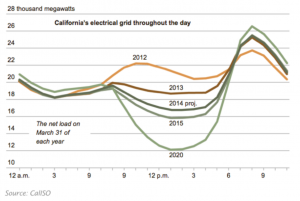

Finally, the rise of renewable energy production in the grid has created new challenges for utilities. Utilities have long faced a deepening “duck curve,” which is greatly exacerbated by the above EV charging profile.

The electric utility market is a government-sanctioned geographic monopoly, and EV charging is fast becoming an important part of that market. We propose a solution to augment that market through tracking EV user habits and incentivizing behavior to flatten the duck curve.

Solution: Platform to augment the EV charging-Utility market and flatten the duck curve

We take inspiration from the NREL researcher that predicted and studied the duck curve: Paul Denholm. In an interview with Vox, he states that if utilities could provide the right price incentives, EV charging could be used to flatten, rather than exacerbate, the duck curve.

We propose creating a platform that connects the electric vehicle’s system to the cloud and use the data collected to collaborate with the utility companies in order to optimize the value for all parties involved. The platform would analyze the driver’s habits and calendar, predict future behavior, then advise the driver when to charge based on both optimized pricing and predicted future driving requirements. It would provide utilities with a representative data set with which they could predict demand and optimally price to encourage flattening the duck curve.

Because this platform would require both widespread deployment of software on EVs (which isn’t yet easily done) and cooperating with an electric utility, we think an EV OEM is best positioned to develop a joint venture with a utility and implement our platform. Therefore, we are proposing this solution for Tesla to incorporate into the software for its electric vehicles. This would be mutually beneficial for drivers, utility companies, and Tesla:

- Drivers: the application would help drivers remove the decision-making process of when and where they should charge their electric vehicle. Using a surge-pricing model, drivers would be incentive to charge their vehicles at locations that best fit their specific priorities (i.e. cost, time, range anxiety). For example, drivers would be able to plug their car in overnight and the system would then optimize at which times that night the car would be charge (i.e. 1am-3am and 5-6:30am).

- Utility companies: By leveraging the data generated by the system, the utility companies would be able to predict electricity usage and optimize energy production and maintenance of its assets in different areas. It would also help them set pricing to encourage smoothing of demand surge throughout the day. Lastly, eventually, utility companies will be able to optimize where to expand when and where to invest in the CapEx of expanding charging stations throughout a particular current city or expand to a new one.

- Tesla: the main benefit for Tesla is the differentiating advantage that it gives them over competitors. For example, Tesla could use the data to negotiate a cheaper electricity rate with utility company, attracting consumers to choose their EV rather than competitors.

Feasibility is increased if an OEM implements this solution.

As the density of EVs which have the solution installed increases within a specific area, the platform will gain more profound insight into the usage patterns of geographically clustered consumers. By understanding their preferred routes, planned trips and holidays, and charging habits, the platform will suggest the most appropriate time for the consumer to charge their EV based on their preferences (i.e. convenience vs pricing).

That considered, the feasibility of the solution rests primarily on the ability for the platform to be scaled. For success, there must be a representative sample in any and all given geographical locations that the solution is marketed for the necessary insights to be achieved.

Given that a lack of scale is the most challenging obstacle preventing a dataset significant enough to draw insights, the implementation will be best suited to rollout from an EV manufacturer. The OEM’s willingness to adopt the software and install as standard in all vehicles will provide the scale required, increasing the utilisation percentage as the EV market booms in the coming decade.

Pilot: Tesla uses OTA to implement a test-run in a small market

Tesla is currently the EV manufacturer best positioned to implement this solution. To begin the pilot, Tesla would implement the algorithm by releasing it as part of an over-the-air (OTA) update to a portion of its existing customer fleet. Data is collected both on the usage of each vehicle and the recharging preferences manually entered by end users. This approach will build on its existing data set of travel routes, providing a deeper understanding of consumer preferences for recharging based on their disclosed preferences and inputs on future travel plans by end users.

Once the customer-specific usage patterns of all Teslas within each specific geography is understood, Tesla can predict future usage patterns for where and when all Teslas are expected to travel and recharge, based on machine learning and AI modelling. This data will identify periods of high demand, which will be of particular interest to utility companies.

Tesla can then share these predictions with utility players, encouraging them to charge variable pricing within specific time periods of geographies. Variable pricing will allow utility providers to smooth out their demand curve and increase margins. In return, Tesla may wish to negotiate lower kWh rates at public charging locations

Competitors & Risks

There are many applications that help EV drivers find charging stations, but none have the ability to predict pricing or analyze a driver’s behavior to recommend charging time.

GM is the main Tesla competitor for plug-in EVs in the US; GM could implement a similar solution. However, this would probably help — it would get more utilities on-board with dynamic EV charging pricing to influence demand curves.

One critical risk is driver adoption of the service. Drivers face significant range anxiety, which is a key barrier to EV adoption (despite the irrationality of this fear). The temptation to plug in the EV and charge it as soon as the driver gets home from work is pretty strong. The application and utility can defeat this in three ways:

- Set prices to significantly incentivize changing charging behavior

- Track savings accrued — recognize good behavior

- Reliably predict the driver’s schedule to avoid an under-charged emergency

Sources

Global EV Outlook 2017 report: https://www.iea.org/publications/freepublications/publication/GlobalEVOutlook2017.pdf

SC Edison report on EVs: https://newsroom.edison.com/internal_redirect/cms.ipressroom.com.s3.amazonaws.com/166/files/20136/SCE-EVWhitePaper2013.pdf

SEPA report on energy grid preparedness for EVs: https://www.utilitydive.com/news/time-is-not-on-their-side-utilities-ill-prepared-for-ev-demand-sepa-finds/519530/

Vox Article with Denholm, discover of the duck curve: https://www.vox.com/energy-and-environment/2018/3/20/17128478/solar-duck-curve-nrel-researcher