A source of inefficiencies is an opportunity for MediLinx

MediLinx aims to be the leading data solutions provider for the healthcare market in Latin America. To do so, MediLinx serves as a third-party SaaS provider for private insurance companies in Latin America. Claims currently are filled out manually, submitted via mail to insurance companies, and then manually re-entered into the computer. The MediLinx solution removes excess inefficiencies by supporting digital record creation, claim automation, and data analytics in medical claim processing. Through this, we will be able to streamline the claim process to make it more efficient and help prevent fraudulent claims.

In Latin America, the current claim processing is slow, outdated and inefficient, thereby generating high administrative costs for the insurance company.

We plan to pilot in Mexico, where we have found and analyzed the main pain points for the insurance companies:

- Claim processing is manual-intensive, requiring excess time spent reviewing and inputting claims

- Fraud (15% of claims)

- Hospitals take too long to fill and send needed forms

Entry strategy and Market Size

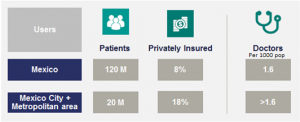

Our end customers are private insurance companies with operations within Latin Americ a. Our initial target customer will be located in Mexico City, and once the concept is proven we will roll out to other major cities in Mexico. After Mexico, we will scale through other major countries in Latin America. Most of our potential clients in Mexico have also a strong presence in Latin America, which will help us to achieve our international expansion.

a. Our initial target customer will be located in Mexico City, and once the concept is proven we will roll out to other major cities in Mexico. After Mexico, we will scale through other major countries in Latin America. Most of our potential clients in Mexico have also a strong presence in Latin America, which will help us to achieve our international expansion.

The healthcare industry in Mexico is estimated in $77bn USD. We are focusing on the private healthcare sector that holds a significant weight over the total expenditure (represents 45% of total health expenses).

Our client are private insurance companies. In Mexico there are over 40 health insurance companies, although 5 players control most of the market share. They serve around 8% of the total population in Mexico, however their penetration in our initial market is much higher, 18%. This market is growing and is expected to double by 2030.

Product Overview

There are two main features of our product, 1) Digitization and 2) Automation. The real value creation comes from the automation; nonetheless digitization is a main feature that enables the automation process.

The claim processing platform consists of a three user system 1) Insurance Company, 2) Patient, 3) Doctor. The patient can upload their documents and fill out the claim forms directly on the platform, as well as the doctor. There (s)he can make the requests to enter a claim for instant processing.

There are two components to the product the front end and back end.

- Front End (Sensors): This is basically the platform for users, composed of three different dashboards. Each dashboard is designed and built to meet each customer’s requirements of the product. Here doctors will input the patient’s claim report. Patients will have a dashboard to view, edit and sign the reports. Insurance will be able to access the final reports with the analytical results attached to each one.

- Back End (Algorithm): The core system is designed to process claims automatically. The system will work through a machine learning process, by analyzing historic and new data to define the parameters that make a claim valid or invalid. The system will review the claim and the insurance policy of the patient in addition to his current status with the insurance to define the validity of the claim. The data is captured (digitized) through either by user-input in the platform or through a scanned picture of the documents. The system will process scanned documents and convert it to digital data, to then be analyzed by the automation process. Once a new claim goes through the system, it will automatically process the claim and determine if it is to be preapproved or subject to manual analysis. The system will build up the reports to output to the different user dashboards.

The ask

The company requires 350k to launch. 30% Will be used for product development, which includes an MVP and the final platform. We will use 20% for the pilot testing, before going into full development, to minimize risk. The rest will be allocated for first year’s salaries and marketing expenses.